Two Cents & a Click: The Wild New Way Startups Are Forcing You to Notice Them

What do you do when nobody opens your cold emails? If you’re Jeeva.ai, you send people two cents through PayPal—with a marketing pitch hidden in the note.

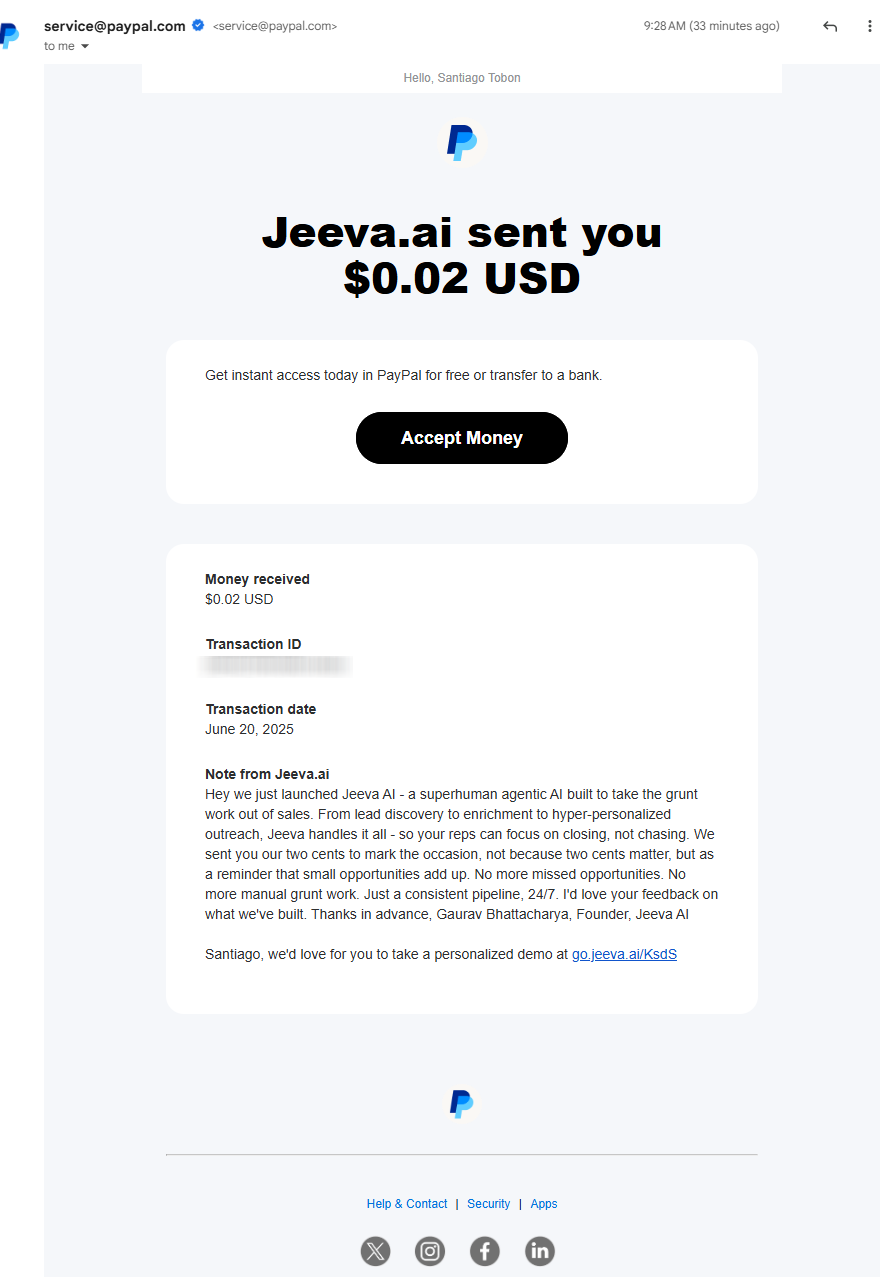

Today, I got a PayPal notification that Jeeva.ai sent me $0.02.

Not an invoice. Not a refund. A literal two-cent deposit—with a marketing pitch in the notes.

At first, I laughed. Then I paused.

And then I realized… this might be one of the cleverest, most disruptive attention grabs I’ve seen in a while.

Welcome to the era of PayPal micro-deposit marketing—a bold, possibly desperate, but undeniably genius way to hack through inbox clutter and land directly in your prospect’s primary attention stream.

Let’s break this down.

📬 The Strategy: Hijack the Platform We Trust Most

The email looks like a standard PayPal notification. Because it is.

Subject line? Legit. Sender? service@paypal.com. Branded formatting? Spot on.

Remember PayPal is online payment service PayPal is available in almost every country in the world

But nestled in that email is a pitch from a startup founder:

“We sent you two cents to mark the occasion… not because two cents matter, but as a reminder that small opportunities add up.”

Translation:

“You're going to read this pitch whether you like it or not—because we paid for your attention inside a platform you can’t ignore.”

It’s bold. It’s weird. And it might actually work.

⚖️ Genius or Desperate?

Let’s be clear:

This is guerrilla marketing at its most literal. You’re weaponizing a financial transaction as a backdoor email delivery method.

Is it genius? Honestly… yes.

Is it a little desperate? Maybe.

But in an age where attention is more expensive than impressions, a two-cent investment for a guaranteed inbox hit feels like a steal.

Instead of fighting spam filters, ad blockers, or low open rates, you're leveraging a platform people trust and open instantly—their PayPal account.

🤯 Why It Works (and Why It Might Backfire)

✅ Why It Works:

- Emails land in the primary inbox, not Promotions or Spam.

- It demands attention. A deposit triggers curiosity (“Why did someone send me money?”).

- It bypasses filters. You’re not emailing from a sketchy cold email tool—you’re riding PayPal’s infrastructure.

- It feels personal. A deposit—even a tiny one—gets processed as a “real” action.

🚫 Why It Might Backfire:

- Feels gimmicky. Some recipients may roll their eyes or flag it as spammy behavior.

- Privacy concerns. Not everyone’s comfortable mixing their inbox and financial platforms with cold pitches.

- It won't scale cleanly. Once it becomes common, the novelty wears off fast.

💡 The Bigger Picture: Would You Pay $0.02 for Someone’s Attention?

In a world where cold emails get buried, ads get ignored, and LinkedIn DMs feel like robocalls, this tactic asks a provocative question:

Would you spend actual money to make sure your message is seen—and if so, how much?

It flips digital marketing on its head.

Instead of paying for impressions, you’re paying for certainty.

That’s a tiny transaction with huge implications.

TL;DR

- PayPal micro-deposit marketing is real.

- It’s bold, weird, possibly annoying—and kind of brilliant.

- Expect more of it (and expect the copycats).

- The challenge now? Using this kind of creativity ethically and effectively.

👀 Want to Try It?

If you’re going to test this out, make sure:

- Your message is genuinely valuable (don’t just spam).

- You’re transparent about who you are and why you're doing it.

- You don’t overdo it. Nobody wants to wake up to 50 x $0.01 deposits.

Sometimes, two cents really can be worth more than a thousand words.

If you are Jeeva.ai, here's my Calendly if you want to talk